Most people who form New Mexico LLCs do not live in New Mexico. Our state is popular with privacy minded individuals, cost-conscious investors, e-commerce companies and those looking to establish holding companies. Our state has no annual reports or fees. You are only required to maintain a registered agent (which every state requires). These are just some of the New Mexico LLC advantages available to those who start a business.

Our state now allows online LLC filings. This allows us to file your LLC the same day and to receive it back within 1-3 business days. Small efforts such as these demonstrate our Secretary of State's commitment to developing a business friendly atmosphere.

This page covers advantages specific to New Mexico, benefits all LLCs enjoy, why operating as a Sole-Proprietorship is a bad idea and the difference between LLCs and Corporations.

Executive Summary: Holding companies and other location independent companies, e.g. e-commerce stores, choose to do business in New Mexico for the privacy and to avoid high fees. Over half of new businesses in NM are limited liability companies due to their anonymity, asset protection and tax benefits. Other states which allow privacy, such as Nevada, Wyoming and Delaware, also charge hundreds of dollars more in fees.

List of Advantages for LLCs in New Mexico

We are a small state which works hard to capture a significant slice of new LLC formations due to the revenue they produce. Below are just a few ways the Secretary makes doing business easy. The online filings and moderate fees show a commitment to creating a friendly haven for companies:

- Anonymous Ownership

- No Managers or Owners Listed

- No Annual Fees or Filings

- No Franchise Taxation

- Everything is Online

- No Need to Visit New Mexico

- No Need to Visit The U.S.

- No Residency Requirements

Your only annual requirement is to have a registered agent in New Mexico. These advantages check off a lot of boxes for small companies and help make make New Mexico LLCs some of the most advantageous for small business owners and privacy minded individuals.

New Mexico LLC Privacy

As stated above, a driving reason many form LLCs in New Mexico is due to their privacy. The Secretary of State does not ask for the names of members or managers. We file EVERY LLC using our name for the Organizer, plus our address for your mailing address and place of business. This keeps your information off the Articles of Organization.

Anonymity is an advantage when dealing with creditors, or if you have nosy neighbors and needy family. In each case, your information will be kept private. Interested in a little more privacy? Then consider one of our mail scanning or virtual office packages.

Annual LLC Fees

New Mexico does not overcharge. There is a one time filing fee and no annual fees afterward. (Learn about New Mexico LLC fees here) There are no required business licenses for those not living here. Even most people living here will not need a license, unless they are in a protected industry such as being an electrician.

You will only have to pay a fee if you want to change your name or dissolve your company. These low fees makes us a popular destination for setting up holding companies.

Interested in moving forward? You can learn more about our LLC formation service here if you believe our state is a good fit for your next venture.

General LLC Advantages vs Sole-Proprietorships

The simplicity of starting an LLC, and the benefits it brings, make LLCs the go to entity for most small businesses. These advantages almost always make LLCs a better fit than Sole-Proprietorships or Corporations:

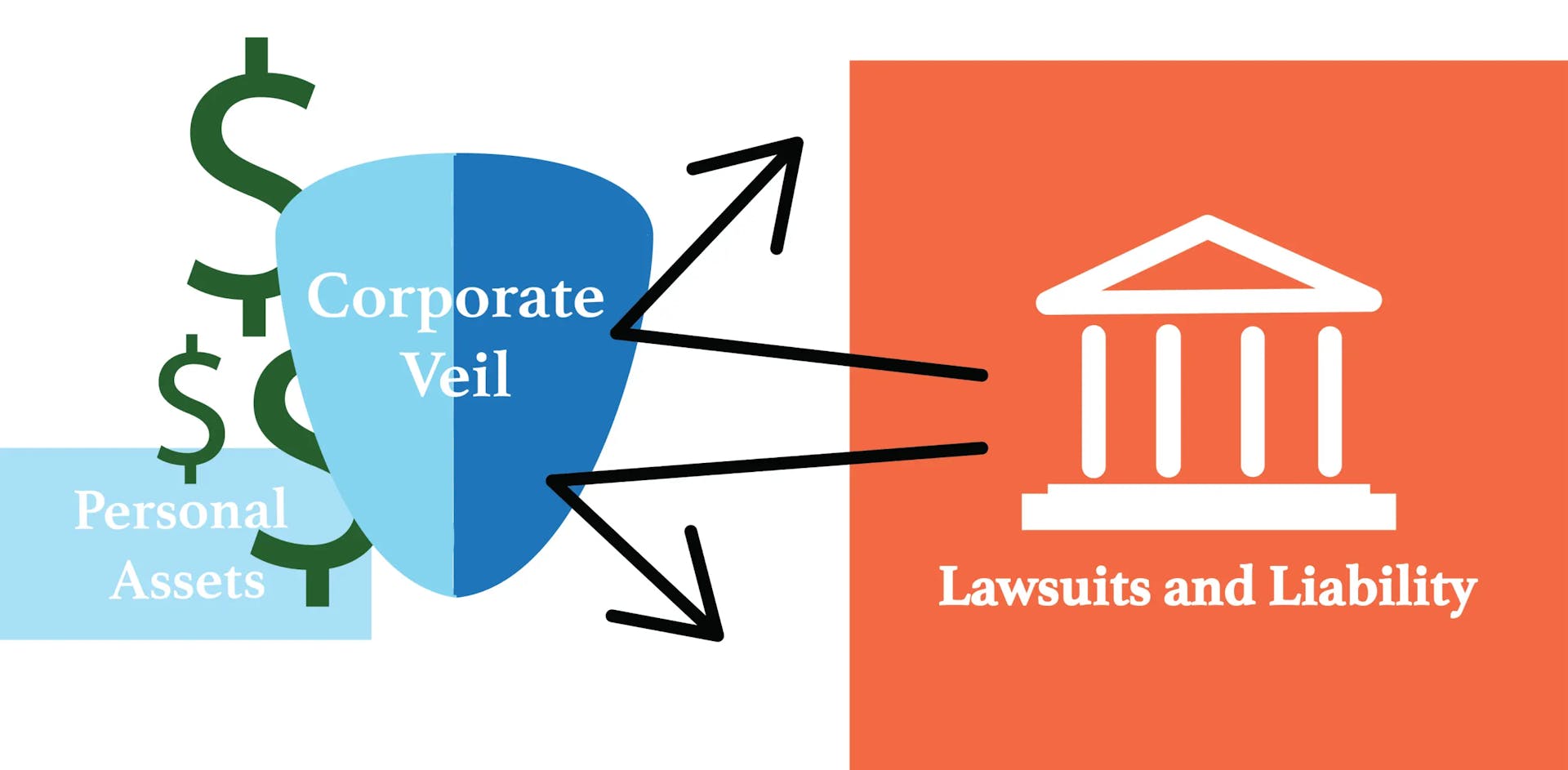

Reason 1) Corporate Veil: This means the company's creditors cannot pursue the owners personally in case of an accident or lawsuit for example. This very benefit is in the name "Limited Liability" Company. This is one of the largest reasons you should not operate as a Sole-Proprietorship.

Reason 2) Lower Taxes: The IRS provides benefits to business owners that sole-props do not receive. You can reduce your income taxes, social security, medicaid and other payments to the government. Learn more about New Mexico LLC taxes here.

Reason 3) More Professional: Clients and vendors have more faith you are serious when you go through the effort of making a company.

The reasons above provide a strong incentive to form an LLC. The resulting asset protection, lower taxes and professionalism outweigh any formation costs. Plus, recent changes to tax laws make setting up an LLC more beneficial than ever.

LLCs versus Corporations

It is common to confuse corporations and LLCs. Corporations have existed for longer than the United States of America. They were among the first forms of business entities allowed. This history has led to a great deal of familiary. Limited Liability Companies were only recently invented, with Wyoming being the first state to allow them. They have quickly become the more popular choice, however. View their respective pros and cons below.

Taxes: Corporations may only be taxed as C-Corps or S-Corps. An LLC may be taxed as a disregarded entity, partnership, S-Corp or C-Corp. This flexibility means you are more likely to find a tax election which suits you and provides the most savings.

Terminology: A Limited Liability Company has owners which are called members and their ownership is referred to as a membership interest. They are organized by filing Articles of Organization. A Corporation's owners are called Shareholders. They incorporate by filing Articles of Incorporation with the Secretary. The largest difference between the two are in how they are taxed and managed.

Corporate Governance: Corporations carry a lot of baggage in terms of governance. They must have a board of directors, officers and shareholders. There must, at minimum, be a President, Secretary and Treasurer. Frequent meetings are required and minutes must be taken. These minutes must be held at the principal place of business and be accessible to shareholders on demand.

An LLC, by comparison, may only have members, or can also add managers. Only one annual meeting is required. Plus, an LLC Operating Agreement tends to be a significantly simpler document than the Corp's Bylaws.

A corporation is infrequently the better choice due to higher taxes and compliance costs. Only very large businessesOnly in rare situations will the split share classes and defined management structure be anything more than a barrier to doing business.

Concluding Thoughts

We believe our state offers many more pros than cons, and our large number of out of state clients confirms this. We also believe most of the people who don't do business here only fail to do so because they aren't aware of all the advantages a New Mexico LLC offers.

Feel free to browse our article comparing NM to Delaware, Nevada and Wyoming LLCs here if you're still not sure. You may also learn more about our New Mexico registered agent service here if you decide to file your Articles yourself with the Secretary.